child tax credit september 2021 delay

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. Experts say that any payments not delivered by winter can be included in your 2021 tax return through the traditional means of obtaining the child tax credit.

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

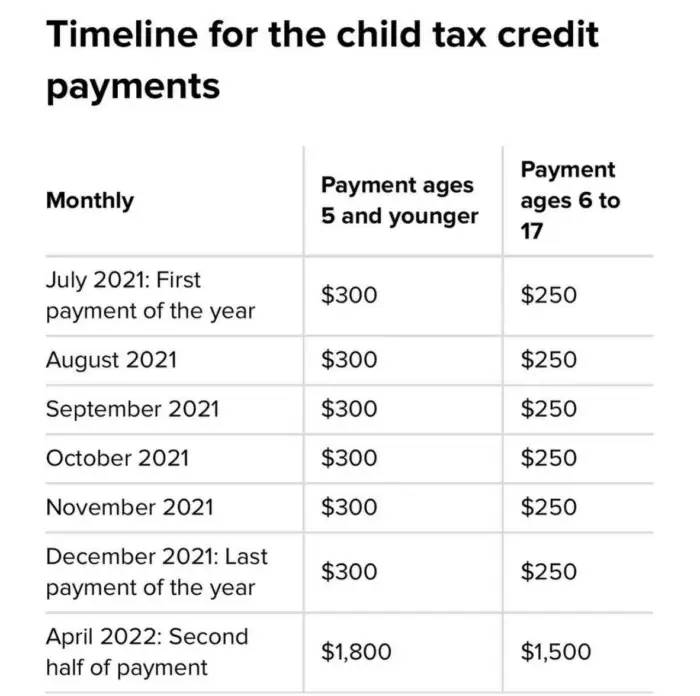

The total child tax credit for 2021 is 3600 for each child under 6 and 3000 for each child 6 to 17 years old.

. 27 2021 1211 pm. 27 2021 605 am. Some families who were expecting a child tax credit payment a week ago still have not received it.

FAMILIES who are claiming child tax credits may have to wait longer for a tax refund than they expect. This will allow new parents with a baby born in 2021 to take advantage of the tax credit payments they now qualify for. Cox Media Group National Content Desk September 22 2021 at 957 am EDT.

While the latest installment of the 2021 Child Tax Credit payments was issued by the IRS on Sept. Some child tax credit payments delayed or less than expected IRS says. 15 some families are getting anxious that they have yet to receive the money.

It will also let parents take advantage of any increased. September 17 2021. The Internal Revenue Service.

The 2021 Child Tax Credit was increased up to 3600 for children under age six and 3000 for those six to 17. Child tax credit payment delayed. However many families are.

This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion. The September 15 checks were the third round of CTC payments and followed the first checks which went out on July 15 and will continue to go out on the 15th of every month. The second half of it.

September 16 2021 735 AM MoneyWatch The third monthly payment of the enhanced Child Tax Credit is landing in bank accounts on Wednesday providing an influx of. Some parents are reporting that they have not yet. N the 15th day of each month families across the United States are supposed to receive advance payments of their 2021 child tax credit money.

IR-2021-188 September 15 2021. How much will parents receive in September. In 2021 the child tax credits were temporarily boosted to 3600 from.

Each month the payments will be either 300 or 250 for each child.

Irs Investigating Why Some Families Didn T Receive September Child Tax Credit

Parents Report They Still Haven T Received September Ctc Payment

Stimulus Update Parents Frustrated By Delays And Issues Getting September S Child Tax Credit The Us Sun

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

1 800 From The Irs On Wednesday It Could Be Reality For Some King5 Com

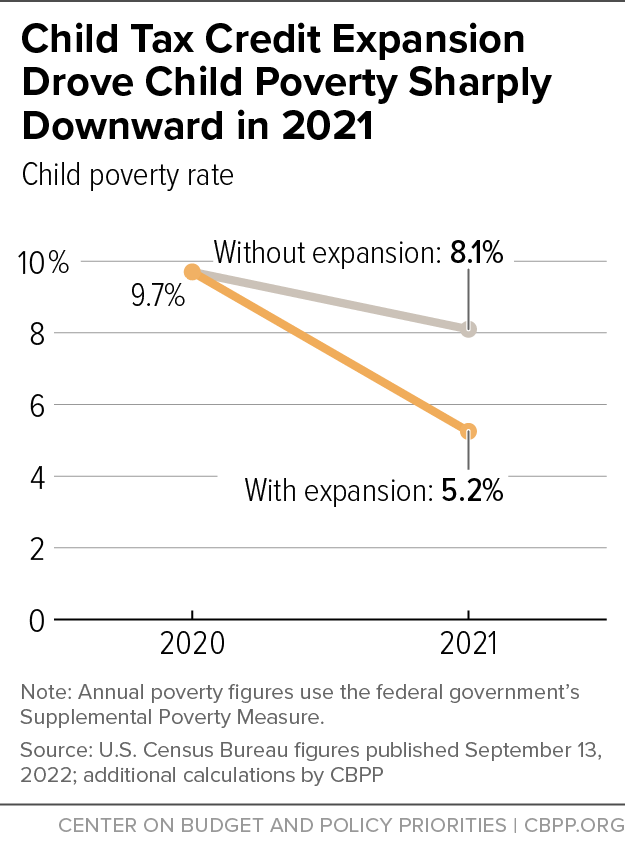

Policymakers Should Expand Child Tax Credit In Year End Legislation To Fight Child Poverty Center On Budget And Policy Priorities

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Kare11 Com

Irs Investigating Why Some Families Didn T Receive September Child Tax Credit

Are You Missing The September Child Tax Credit Payment Wfmynews2 Com

Why Was Your Child Tax Credit Payment Less This Month Mcclatchy Washington Bureau

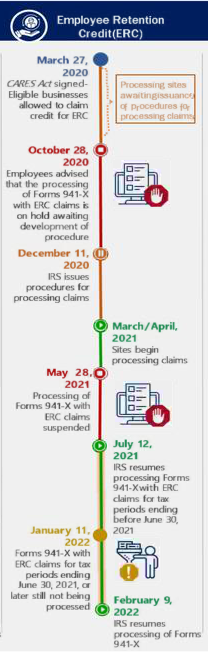

An Irs Erc Refund Status Report From The Treasury Inspector General Employer Services Insights

What To Know About September Child Tax Credit Payments Forbes Advisor

People Have Already Received Their 300 Per Child Tax Payment Here S How To Check On Yours

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Parents Fury Over Delayed 300 Child Tax Credit Payment They Depend On As Irs Battle September 15 Backlog The Us Sun

Irs Investigating Why Some Families Didn T Receive September Child Tax Credit

Delayed Child Tax Credit Payment Leaves Parents Fuming But Irs Promises You Should Get It Soon The Us Sun

Child Tax Credit Portal Glitch Delayed Some September Payments Don T Mess With Taxes